Funding through a Yieldco (or Yield Company)

5th Avenue Capital has a strong relationship with 1 of only a handful of existing Yield Companies (Yieldcos) in the USA and the world. Our relationship with this yield company allows us to fund specific projects that are able to produce a stable and predictable ROI.

What is a YieldCo or Yield Company?

By definition, a Yield Company or Yieldco is a publicly traded corporation or entity (similar to an MLP or Master Limited Partnership) that yields a fairly stable & predictable stream of cashflow to a limited set of investors through working assets (usually renewable energy assets like solar and wind farms).

While not all Yield Companies are limited to only renewable energy assets for their “portfolio”, this is the traditional structure of assets.Some Yield Companies also invest in non-renewable energy businesses as long as they meet the predictable return requirements for the Yieldco and it’s shareholders.

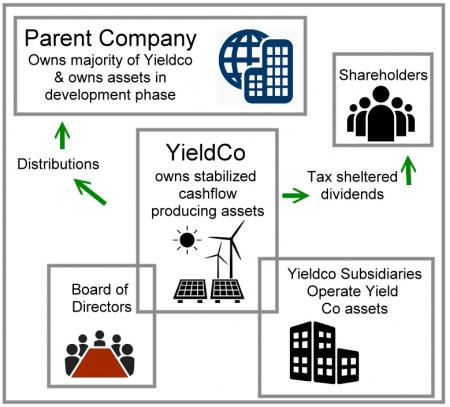

A YieldCo can more generically be viewed as a fund that invests in reliable, stable businesses and other assets that gives yields to a specific pool of investors that have “stock” in the fund or yield company. For traditional yieldcos, renewable energy assets are both a stable form of ROI for the parent company and its investors because of the stability and predictability of the asset class, but also because of low volatility and tax incentives for renewable energy assets that minimize tax liabilities for the yield company and its investors. In addition, the Parent company of a Yieldco is typically a larger energy company or other structure that owns the majority interest in the Yieldco and receives regular distributions from the performance of the assets owned by the YieldCo. For the shareholder / investors, Yieldcos have advantages in the areas of:Structure: The shareholders of a Yieldco typically receive tax sheltered dividends in the form of a 1099 rather than a K-1 because the Yieldco is structured as a Corporation, not a partnership (see diagram). Tax advantages: Yieldcos, which typically own renewable energy assets, are able to take advantage of tax incentives specifically put into law for development and proliferation of these renewable energy assets. Additionally, YieldCos can be held in Mutual Funds, ETFs, and Closed End Funds that are structured as RICs (Regulated Investment Companies). This does not subject the funds to fund-level taxation, an advantage over MLPs (Master Limited Partnerships).

For the stockholders, cash distributions can often be considered “return of capital”, and this lowers the cost basis for the stockholders/ investors. In addition, when the assets under the YieldCo are sold, because of the longevity nature of the asset within the company, the tax rate falls under the long-term capital gains rate. Yield: In 2015, the average dividend for listed YieldCos was 6.2%. Dividend Growth: YieldCos are structured so they can offer potential dividend growth because, by nature, they are always acquiring new cashflow producing assets. Lower Volatility: Because the Yieldco owns assets that are fully developed with long-term contracts, the volatility is significantly low. The independent Board of Directors helps to pursue and secure opportunities between the YieldCo and Parent Company, as well as mitigating price uncertainty and development risk.

Getting Funded through a Yield Company

How does a Yieldco typically fund projects? There are only a handful of Yieldcos in the world, and each of them is different in how they select their asset projects to develop and maintain, but they typically seek projects that are in the renewable energy field (solar and wind farms). However, 5th Avenue Capital has a relationship with a YieldCo that also invests in other types of projects including infrastructure with government guaranteed annuities, conversion technologies, industrial assets, real estate, condo and commercial development, and more.